To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000 as follows. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized.

Provision For Income Tax Definition Formula Calculation Examples

What is personal tax rate in Malaysia.

. He or she has been resident in Malaysia for less than 182 days of the tax year but was resident in the. Introduction Individual Income Tax. Individual Life Cycle.

1 Corporate Income Tax 11 General Information Corporate Income Tax. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00. As a non-resident youre are also not eligible for any tax deductions.

In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. For 2022 tax year. Malaysia personal income tax guide 2019 YA 2018 242019 62800 AM KUALA LUMPUR April 2 Income tax season is here in Malaysia so.

Chargeable income bands MYR Current tax rates Proposed 2018 tax rates 05000. Accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual. Nonresident individuals are taxed at a flat rate of 28.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. Taxable Income MYR Tax Rate. Malaysia Personal Income Tax Guide.

Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26 1000000 237650 28 A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPFdeductions has to register a tax file.

Tax Rate Table 2018 Malaysia masuzi December 14 2018 Uncategorized Leave a comment 0 Views Income tax how to calculate bonus and personal tax archives updates malaysian tax issues for expats audit tax accountancy in johor bahru. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. You can check on the tax rate accordingly.

Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual. Corporate tax rates for companies resident in Malaysia is 24. Offences Penalties Failure to furnish Income Tax Return RM200 to RM20000 or imprisonment or both on conviction or 300 of tax payable in lieu of prosecution Failure to furnish Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or.

The maximum rate was 30 and minimum was 25. On the First 5000. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Personal Income Tax Rate in Malaysia remained unchanged at 30 in 2021. Assessment Year 2018 Assessment Year.

Assessment Year 2018-2019 Chargeable Income. The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. Receiving tax exempt dividends.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Headquarters of Inland Revenue Board Of Malaysia. He or she has been resident in Malaysia for 182 days of the tax year.

The amount of tax relief 2018 is determined according to governments graduated scale. If taxable you are required to fill in M Form. Offences under the Income Tax Act 1967 and the penalties thereof include the following.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Introduction Individual Income Tax. The decision on how much of the individual income tax revenue needed be paid are decided on every years budget meeting in Parliament.

Calculations RM Rate TaxRM 0 - 5000. Data published Yearly by Inland Revenue Board. Tax rates range from 0 to 30.

Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. It should be noted that this takes into account all. 23 rows Tax Relief Year 2018.

Taxable Income Formula Calculator Examples With Excel Template

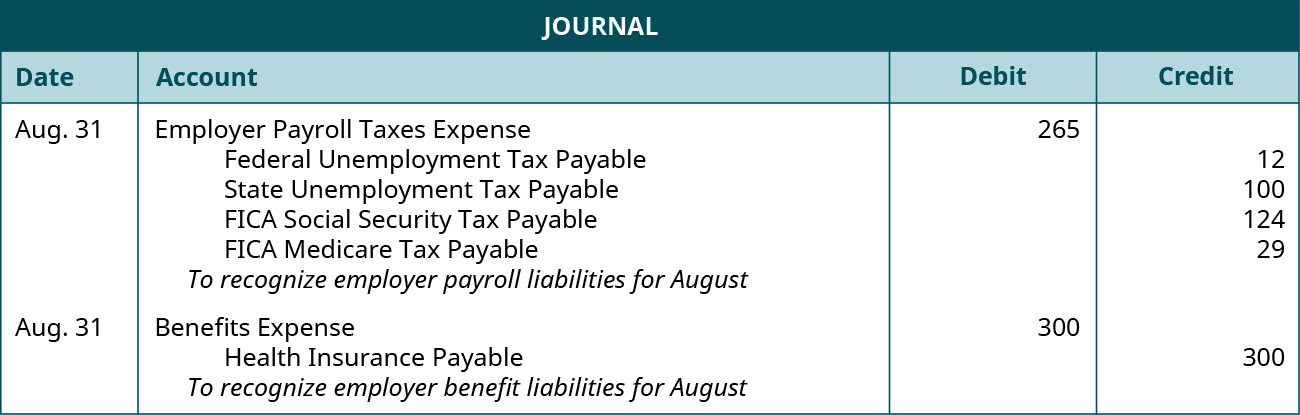

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Individual And Corporate Tax Reform

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)